Mass food tax, a subject that has sparked discussions worldwide, is a form of taxation levied on the consumption of food items. This tax has been implemented in various forms, with varying motivations and impacts. In this article, we delve into the intricacies of mass food tax, examining its types, implications, and ethical considerations.

From value-added taxes (VAT) to sales tax, different types of mass food taxes exist, each with its own mechanisms and consequences. Understanding these variations is crucial for policymakers and consumers alike.

Alternative Approaches to Food Taxation

Beyond a general food tax, alternative approaches to food taxation exist, each with its own advantages and disadvantages.

One alternative approach is targeted subsidies. Rather than taxing all food, targeted subsidies provide financial assistance to low-income households or individuals to purchase healthy food options. This approach ensures that those most in need have access to nutritious food while minimizing the impact on the overall food supply.

Nutrient-Based Taxes

Another alternative approach is nutrient-based taxes. These taxes specifically target foods high in unhealthy nutrients, such as saturated fat, sugar, or sodium. By increasing the cost of these foods, nutrient-based taxes discourage their consumption and promote healthier choices.

- Advantages:Nutrient-based taxes can effectively reduce the consumption of unhealthy foods, leading to improved public health outcomes.

- Disadvantages:They can be complex to implement and may disproportionately impact low-income households who rely on less expensive, processed foods.

International Perspectives

Globally, numerous countries have implemented mass food taxes, offering insights into their effectiveness and lessons learned.

One notable example is Denmark’s “fat tax,” imposed in 2011. The tax targets foods with high levels of saturated fats, aiming to promote healthier choices. While initially met with resistance, it has since been credited with reducing the consumption of unhealthy fats by 10%.

Lessons Learned

- Taxes should be carefully designed to minimize unintended consequences, such as shifting consumption to untaxed, equally unhealthy options.

- Public education and awareness campaigns are crucial for the success of mass food taxes.

- Revenue generated from taxes can be used to support health-related initiatives, further promoting healthy choices.

Best Practices

- Taxes should be based on objective nutritional criteria, focusing on foods high in unhealthy fats, sugar, or salt.

- Taxes should be implemented gradually to allow consumers to adjust their consumption habits.

- Governments should collaborate with food manufacturers to reduce the availability of unhealthy foods and promote healthier options.

Ethical Considerations

Mass food taxes raise ethical concerns that must be carefully considered. These taxes have the potential to impact equity, affordability, and the fundamental right to food.

Equity

Mass food taxes can disproportionately affect low-income households. These households spend a larger proportion of their income on food, making them more vulnerable to price increases. Additionally, low-income households often have limited access to healthy and affordable food options, making it more challenging for them to adjust their diets in response to higher food prices.

Affordability

Mass food taxes can make healthy food less affordable for all consumers. This can have negative consequences for public health, as access to nutritious food is essential for well-being. Higher food prices can lead to increased food insecurity, where individuals and families struggle to obtain adequate food.

Right to Food

Mass food taxes can also raise concerns about the right to food. The United Nations recognizes the right to food as a fundamental human right. This right includes the ability to access adequate, safe, and nutritious food. Mass food taxes that make food less affordable or accessible could potentially violate this right.

Implementation Challenges: Mass Food Tax

Mass food taxes present various implementation challenges, including administrative complexities, compliance issues, and potential loopholes that need to be carefully addressed to ensure effective implementation and achievement of intended objectives.

One of the key challenges is the administrative burden associated with implementing a mass food tax. This includes the need for robust tracking and monitoring systems to ensure accurate tax collection and prevent evasion. Additionally, determining the appropriate tax rates for different food items can be a complex process, requiring careful consideration of nutritional value, affordability, and potential unintended consequences.

Compliance Issues

Compliance with mass food taxes can also be challenging, particularly for small businesses and individuals with limited resources. The complexity of tax regulations and the potential for penalties can create a disincentive for compliance. Moreover, the informal nature of food markets in many developing countries can make it difficult to enforce tax collection.

Potential Loopholes

Loopholes and exemptions in mass food taxes can undermine their effectiveness and lead to inequitable outcomes. For example, exemptions for certain food items or businesses can create opportunities for tax avoidance and reduce the overall impact of the tax. Additionally, the definition of “unhealthy” foods can be subjective and open to interpretation, potentially leading to inconsistencies in tax application.

Policy Recommendations

To implement effective and equitable mass food taxes, policymakers should consider the following recommendations:

Taxes should be designed to target unhealthy foods while minimizing the impact on healthy options. This can be achieved through tiered tax rates based on nutritional content, such as sugar, saturated fat, and sodium.

Mitigating Negative Impacts

To mitigate potential negative impacts on low-income households, governments can provide tax credits or subsidies for healthy food purchases. Additionally, targeted nutrition education programs can help consumers make informed choices and reduce the overall consumption of unhealthy foods.

Maximizing Benefits, Mass food tax

To maximize the benefits of mass food taxes, revenues should be earmarked for public health initiatives, such as nutrition education, obesity prevention programs, and infrastructure improvements that promote healthy eating.

Clarifying Questions

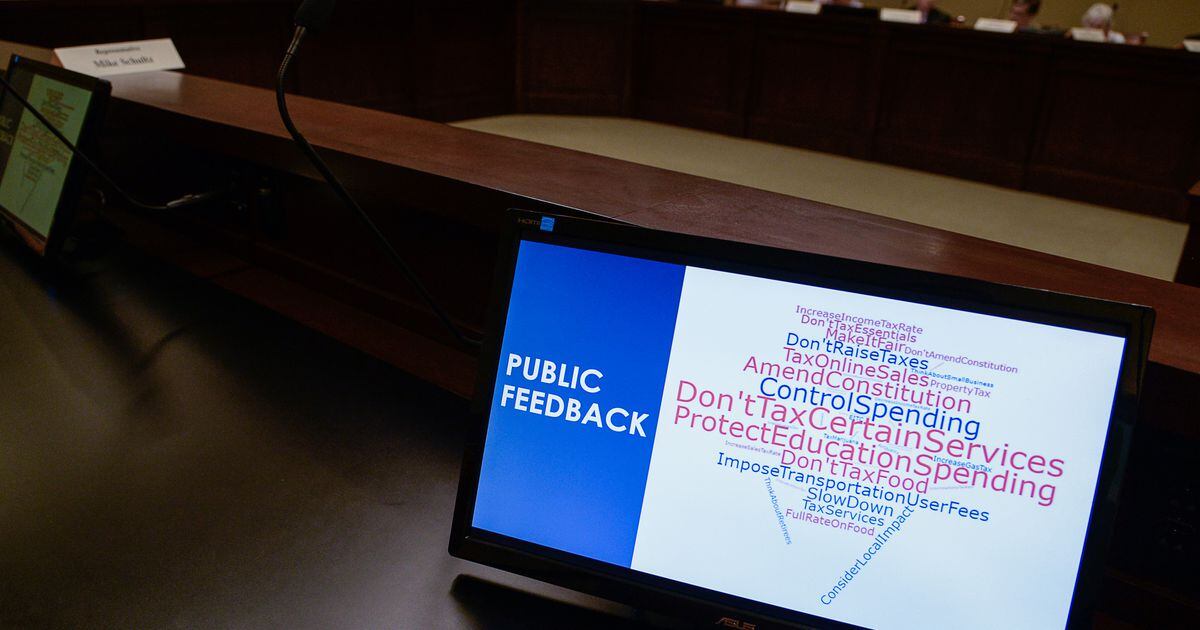

What are the primary motivations for implementing a mass food tax?

Mass food taxes can be motivated by various factors, including raising revenue for public services, promoting healthier food choices, and reducing the environmental impact of food production.

How does a mass food tax impact consumer behavior?

Mass food taxes can influence consumer behavior by making certain foods more expensive, potentially leading to shifts in purchasing patterns and consumption habits.

What are the potential distributional consequences of a mass food tax?

Mass food taxes can have distributional consequences, as they may disproportionately affect low-income households and vulnerable populations who spend a larger share of their income on food.