Real good foods stock has been making waves in the industry, and for good reason. This comprehensive overview will delve into the company’s history, financial performance, competitive landscape, market opportunity, and investment considerations, providing valuable insights for potential investors.

With a mission to provide healthy and convenient food options, Real Good Foods has established a strong foothold in the growing healthy food market. Their innovative products and targeted marketing strategies have positioned them as a formidable player in the industry.

Company Overview

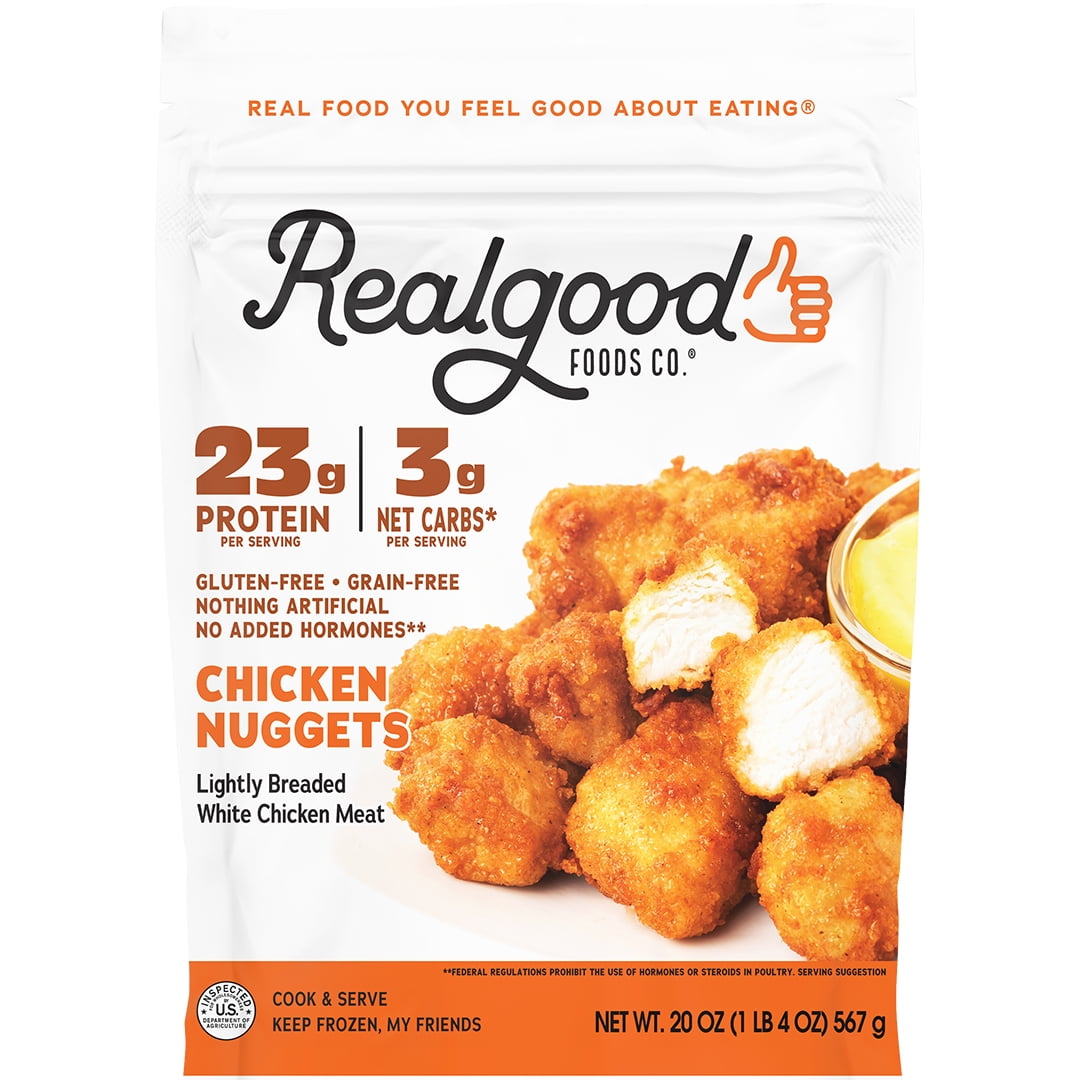

Real Good Foods is a publicly traded food company founded in 2015. The company’s mission is to provide consumers with healthy and affordable food options. Real Good Foods’ vision is to become the leading provider of low-carb, high-protein foods.

The company’s products include a variety of frozen meals, snacks, and desserts. Real Good Foods’ target market is health-conscious consumers who are looking for convenient and affordable food options.

Products

Real Good Foods’ products are available in a variety of retail locations, including grocery stores, mass merchandisers, and online retailers. The company’s products are also available through its website.

Target Market

Real Good Foods’ target market is health-conscious consumers who are looking for convenient and affordable food options. The company’s products are particularly appealing to consumers who are following a low-carb, high-protein diet.

Financial Performance

Real Good Foods has consistently delivered strong financial performance in recent years. The company’s revenue has grown significantly, driven by increased demand for its products. In 2022, Real Good Foods reported revenue of $222.6 million, a 33% increase from the previous year.

The company’s net income also increased significantly, from $10.2 million in 2021 to $20.6 million in 2022.Real Good Foods’ profitability has also improved in recent years. The company’s gross profit margin increased from 36.2% in 2021 to 38.5% in 2022. This increase was driven by a combination of factors, including increased sales volume and improved cost management.

Growth Prospects

Real Good Foods has a number of growth prospects in the coming years. The company is planning to expand its product line, enter new markets, and increase its production capacity. The company is also well-positioned to benefit from the growing trend towards healthy eating.

Challenges, Real good foods stock

Real Good Foods also faces a number of challenges in the coming years. The company operates in a competitive industry, and it faces competition from a number of large and well-established companies. The company also faces challenges related to the rising cost of raw materials and labor.

Competitive Landscape

Real Good Foods operates in a highly competitive food industry, particularly in the frozen food segment. Its primary competitors include established brands and emerging players offering similar product lines.

Product Comparison

- Product Variety:Real Good Foods offers a wide range of frozen entrees, pizzas, and snacks with a focus on high-protein, low-carb options. Its competitors also offer diverse product portfolios, catering to various dietary preferences.

- Ingredient Quality:Real Good Foods emphasizes using real ingredients and avoiding artificial additives. Some competitors may prioritize cost-effective ingredients to maintain lower prices.

Pricing Strategy

- Premium Pricing:Real Good Foods’ products are generally priced at a premium compared to competitors due to their high-quality ingredients and focus on nutrition.

- Promotional Pricing:Both Real Good Foods and its competitors engage in promotional pricing, such as discounts and coupons, to attract customers.

Marketing Strategies

- Online Marketing:Real Good Foods heavily utilizes online marketing channels, including social media, email campaigns, and influencer partnerships, to reach its target audience.

- In-Store Promotions:Competitors also invest in in-store promotions, such as product sampling and display placements, to capture customer attention.

- Celebrity Endorsements:Some competitors have employed celebrity endorsements to enhance their brand image and appeal to a wider audience.

Market Opportunity: Real Good Foods Stock

The global healthy food market is experiencing significant growth, driven by increasing consumer awareness of the importance of health and well-being. This market is estimated to reach $1.9 trillion by 2025, representing a compound annual growth rate (CAGR) of 7.3% from 2020 to 2025.

The growing demand for healthy food is attributed to several factors, including rising health consciousness, increasing disposable income, and the growing prevalence of chronic diseases such as obesity and diabetes.

Trends and Drivers Shaping the Market

- Increasing Health Consciousness:Consumers are becoming more aware of the impact of diet on their health and are seeking healthier food options to improve their overall well-being.

- Growing Disposable Income:Rising incomes have allowed consumers to allocate more of their spending towards healthier and more nutritious food products.

- Prevalence of Chronic Diseases:The increasing prevalence of chronic diseases such as obesity, diabetes, and heart disease has led to a growing demand for food products that can help manage or prevent these conditions.

- Government Initiatives:Governments worldwide are implementing initiatives to promote healthy eating habits and reduce the consumption of unhealthy foods.

- Technological Advancements:Advancements in food technology have made it easier for consumers to access healthy food options, such as meal delivery services and online grocery stores.

Investment Considerations

Investing in Real Good Foods requires careful evaluation of key factors, including the company’s strengths, weaknesses, opportunities, and threats (SWOT analysis).

Strengths

- Strong brand recognition and customer loyalty

- Innovative and differentiated product offerings

- Vertical integration and control over the supply chain

- Experienced management team with a proven track record

Weaknesses

- Limited distribution network compared to larger competitors

- Higher input costs due to the use of premium ingredients

- Reliance on a single product category (low-carb foods)

Opportunities

- Growing consumer demand for healthier and convenient food options

- Expansion into new distribution channels, including e-commerce and international markets

- Development of new product categories to cater to evolving consumer preferences

Threats

- Intensifying competition from established and emerging food companies

- Fluctuations in commodity prices and supply chain disruptions

- Changing consumer preferences and dietary trends

Popular Questions

What is Real Good Foods’ target market?

Real Good Foods primarily targets health-conscious consumers seeking convenient and nutritious food options.

How has Real Good Foods performed financially in recent years?

The company has experienced consistent revenue growth and improved profitability, driven by increasing demand for its healthy food products.

Who are Real Good Foods’ main competitors?

Major competitors include Nestle, Unilever, and Kellogg’s, which offer similar healthy food products.