Illinois tax food laws have a significant impact on consumers, businesses, and the state’s revenue. This guide provides an overview of the current tax laws, their impact on consumers, the revenue generated, comparisons to other states, and potential future changes.

Understanding the complexities of Illinois tax food is crucial for making informed decisions about food purchases, business operations, and policy changes.

Illinois Tax Food Laws

The Illinois tax laws for food are designed to generate revenue for the state government. The tax laws are complex and can be difficult to understand. This article will provide an overview of the current tax laws for food in Illinois, including examples of food items that are taxed and non-taxed, as well as any recent changes or updates to the tax laws.

Taxed Food Items

Most food items purchased in Illinois are subject to the state’s sales tax of 6.25%. This includes food purchased at grocery stores, restaurants, and convenience stores. However, there are some exceptions to the sales tax on food. These exceptions include:

- Food purchased with food stamps

- Food purchased by charitable organizations

- Food purchased for immediate consumption on the premises of the seller

Non-Taxed Food Items

There are a number of food items that are not subject to the sales tax in Illinois. These items include:

- Groceries

- Prescription drugs

- Baby food

- Pet food

Recent Changes to the Tax Laws

There have been no recent changes to the tax laws for food in Illinois.

Impact of Food Taxes on Consumers

Food taxes in Illinois have a significant impact on consumers, particularly low-income households. These taxes disproportionately affect certain groups and can pose challenges to food security.

One of the main impacts of food taxes is the increased cost of groceries. When food is taxed, consumers pay more for essential items, such as fruits, vegetables, and dairy products. This can strain household budgets and make it difficult for families to afford healthy and nutritious food.

Disproportionate Impact on Low-Income Households

Low-income households are disproportionately affected by food taxes. These households often spend a larger percentage of their income on food, so any increase in food prices can have a significant impact on their ability to afford other necessities, such as housing, transportation, and healthcare.

Strategies to Mitigate Impact

There are several strategies that can be implemented to mitigate the impact of food taxes on low-income households. These include:

- Tax exemptions: Exempting certain food items from taxation, such as fruits and vegetables, can help reduce the cost of groceries for low-income households.

- Subsidies: Providing subsidies for food purchases can help offset the cost of food taxes for low-income households.

- SNAP benefits: Expanding SNAP (Supplemental Nutrition Assistance Program) benefits can provide additional assistance to low-income households in purchasing food.

Revenue Generated from Food Taxes

Food taxes are a significant source of revenue for the state of Illinois. In fiscal year 2023, food taxes generated approximately $1.9 billion, accounting for 6.5% of the state’s total tax revenue.

The revenue generated from food taxes is allocated to various state programs, including education, healthcare, and infrastructure. A portion of the revenue is also used to fund tax relief programs for low-income families.

Potential for Alternative Sources of Revenue

There are several potential alternative sources of revenue that could replace food taxes. These include:

- Sales tax on non-food items

- Income tax

- Property tax

Each of these alternative sources of revenue has its own advantages and disadvantages. Sales tax on non-food items would be a broader tax that would generate more revenue than food taxes. However, it would also be more regressive, meaning that it would disproportionately impact low-income families.

Income tax is a progressive tax that would generate less revenue than food taxes. However, it would be more equitable, meaning that it would be more evenly distributed across all income levels.

Property tax is a local tax that would generate revenue for local governments. However, it is a regressive tax that would disproportionately impact low-income families.

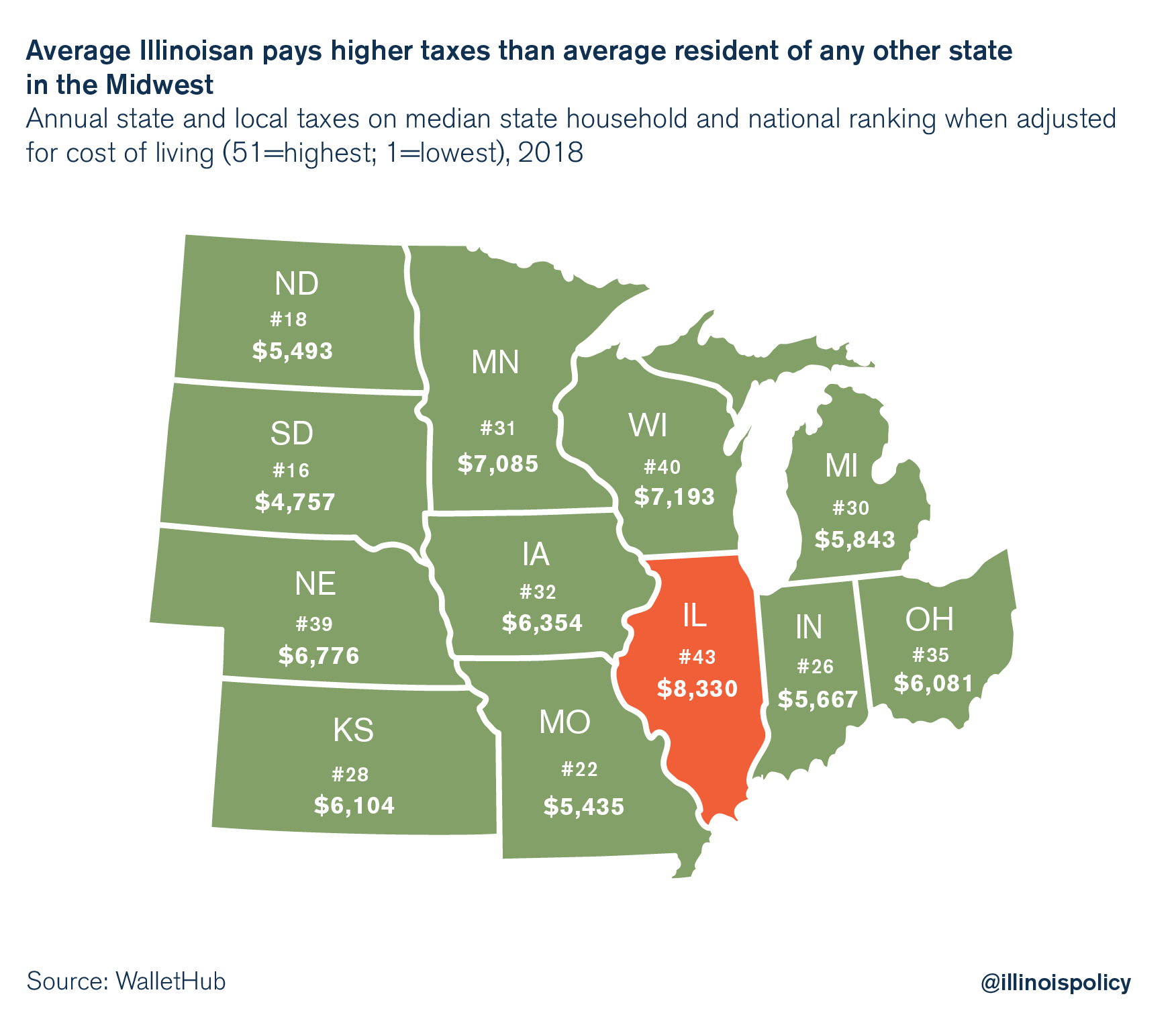

Comparison to Other States

Illinois’ food tax laws differ from those of its neighboring states in several ways. These differences can have a significant impact on consumers and businesses.

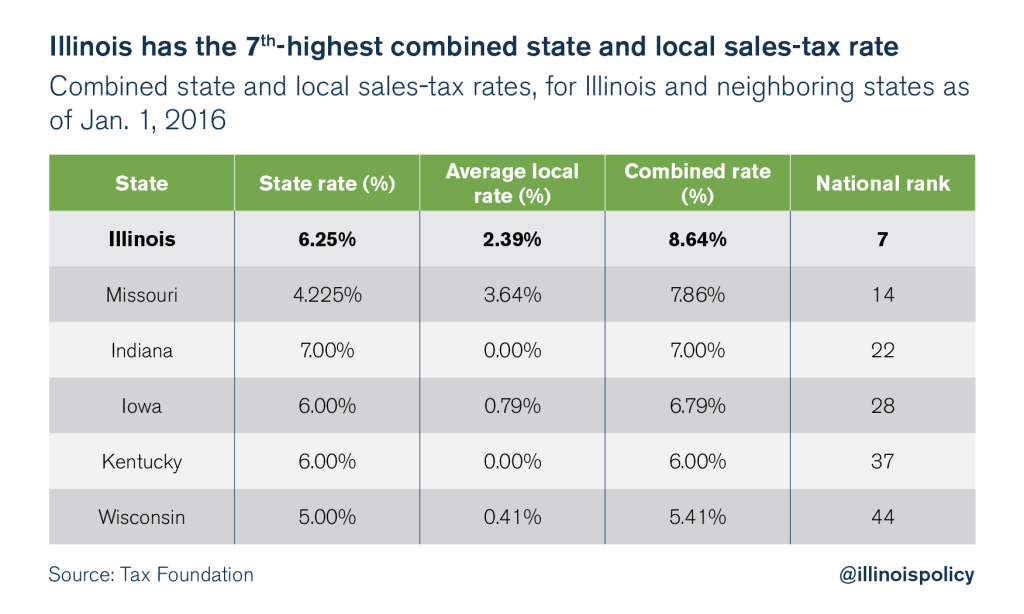

Tax Rates

Illinois has a relatively high food tax rate compared to its neighbors. The state’s general sales tax rate is 6.25%, and food is subject to the full rate. This means that consumers in Illinois pay more for food than consumers in most neighboring states.

Exemptions

Illinois has a number of exemptions to its food tax. These exemptions include:

- Groceries

- Food purchased with food stamps

- Food served at restaurants with less than $10 million in annual sales

These exemptions help to reduce the impact of the food tax on low-income families and small businesses.

Impact on Consumers and Businesses

The differences in food tax laws between Illinois and its neighboring states can have a significant impact on consumers and businesses.

Consumers in Illinois pay more for food than consumers in most neighboring states. This can be a significant burden for low-income families.

Businesses in Illinois may be at a competitive disadvantage compared to businesses in neighboring states with lower food tax rates. This is because businesses in Illinois must pass on the cost of the food tax to their customers.

Future of Food Taxes in Illinois: Illinois Tax Food

The future of food taxes in Illinois is uncertain, as there are several potential changes or reforms that could be implemented. These changes could be driven by a variety of factors, including the state’s budget situation, the political climate, and the evolving landscape of the food industry.

One potential change is the elimination of the sales tax on food. This would be a significant change, as it would reduce the cost of food for consumers and potentially stimulate the economy. However, it would also reduce the amount of revenue generated by the state, which could lead to cuts in government services.

Another potential change is the implementation of a graduated food tax. This type of tax would apply a higher tax rate to unhealthy foods, such as sugary drinks and processed snacks. This could help to improve the health of Illinois residents and reduce the state’s healthcare costs.

However, it could also be seen as unfair to low-income families, who spend a larger proportion of their income on food.

Stakeholders Involved in the Debate over Food Taxes, Illinois tax food

There are a variety of stakeholders involved in the debate over food taxes in Illinois. These stakeholders include:

- Consumers: Consumers are the ultimate payers of food taxes, and they have a vested interest in ensuring that these taxes are fair and reasonable.

- Businesses: Businesses that sell food are also affected by food taxes. These businesses must collect and remit the tax to the state, and they may also pass on the cost of the tax to consumers.

- Government: The government of Illinois is responsible for collecting and spending the revenue generated by food taxes. The government has an interest in ensuring that food taxes are generating sufficient revenue to meet the state’s needs.

- Public health advocates: Public health advocates are concerned about the impact of food taxes on the health of Illinois residents. They believe that food taxes can be used to discourage the consumption of unhealthy foods and promote the consumption of healthy foods.

Political and Economic Factors that will Influence the Future of Food Taxes in Illinois

The future of food taxes in Illinois will be influenced by a variety of political and economic factors. These factors include:

- The state’s budget situation: The state’s budget situation will play a major role in determining the future of food taxes. If the state is facing a budget deficit, it may be more likely to raise food taxes in order to generate additional revenue.

- The political climate: The political climate in Illinois will also influence the future of food taxes. If there is a strong public outcry against food taxes, the state legislature may be less likely to raise them.

- The evolving landscape of the food industry: The evolving landscape of the food industry will also affect the future of food taxes. As the food industry changes, the state may need to adjust its food tax laws in order to keep up.

Commonly Asked Questions

What food items are taxed in Illinois?

Prepared food, restaurant meals, and groceries are subject to sales tax in Illinois.

How much is the sales tax on food in Illinois?

The state sales tax rate is 6.25%, and local taxes can add an additional 1-2%.

Are there any exemptions to the food sales tax in Illinois?

Yes, certain food items such as fresh fruits, vegetables, and bread are exempt from sales tax.